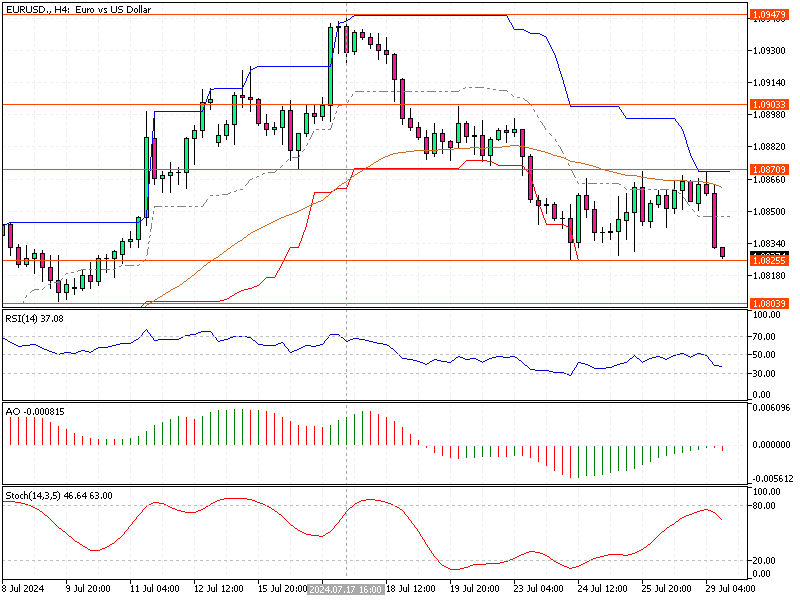

EURUSD Fundamental Analysis – 29-July-2024

The Euro has extended its decline to $1.082, moving further away from the four-month high of $1.094 reached on July 17th. This downward trend follows the release of weak Purchasing Managers’ Index (PMI) data for the Eurozone, Germany, and France.

The PMI data showed unexpected stagnation in private sector activity for July, driven by a more significant contraction in manufacturing and a slowdown in services. Notably, Germany and France continue to underperform compared to the broader Eurozone.

Impact on ECB Interest Rate Expectations

In light of the disappointing PMI figures, market expectations for the European Central Bank (ECB) to implement two additional interest rate cuts this year have increased significantly. Before the PMI release, the probability of two rate cuts was less than 80%, which has now surged to 90%.

Traders are closely watching the ECB’s moves, as rate cuts generally aim to stimulate economic activity by making borrowing cheaper, but they also tend to weaken the currency.

ECB’s Future Policy Considerations

ECB Vice President Luis de Guindos has indicated that the central bank will have more information by September, including new macroeconomic projections. This data will help the ECB reassess its monetary policy stance.

Last week, the ECB kept interest rates unchanged, as expected. President Christine Lagarde stated that the decision for September remains “wide open,” signaling that the central bank is carefully considering its next steps in response to evolving economic conditions.

- Read also: USDMXN Analysis – 25-July-2024

EURUSD Fundamental Analysis – 29-July-2024

Given the current economic indicators and the ECB’s cautious approach, the Euro will likely remain under pressure. Investors should monitor upcoming economic data releases and ECB communications closely, as these will provide further insights into the central bank’s policy direction.

The anticipated rate cuts may continue to lower the Euro, impacting international trade and investment strategies. Understanding these dynamics is crucial for making informed decisions in the current economic landscape.

Comments are closed.