GBPUSD Fundamental Analysis – 8-August-2024

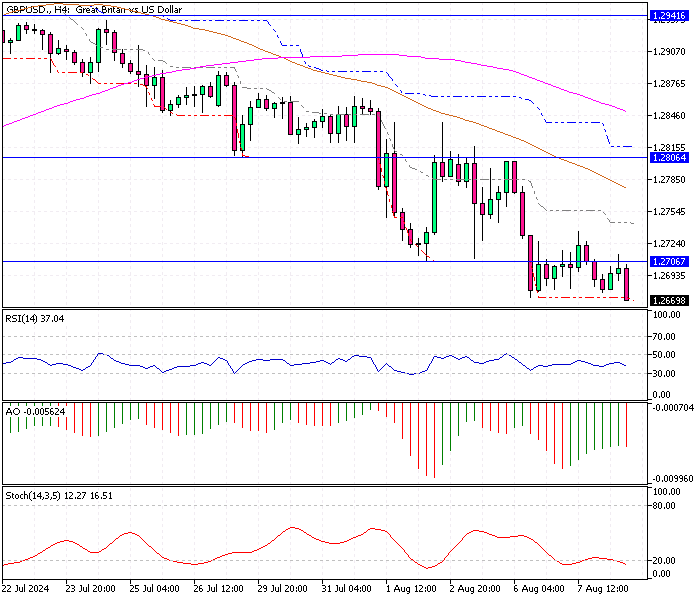

The British pound has fallen to $1.266 (GBP/USD), nearing a one-month low, as investors expect the Bank of England to cut interest rates more quickly. This drop is also tied to concerns about a potential US recession, which has pushed British government bond yields to new lows not seen in several months.

Currently, markets are predicting two quarter-point interest rate cuts by the BoE before the end of the year. On Monday, the interest rate futures market showed a total expectation of 56 basis points of cuts for this year, an increase from the 47 basis points expected last Friday. This means the market is now more convinced that the BoE will reduce rates significantly than previously thought.

- Also read: EURUSD Fundamental Analysis – 8-August-2024

Moreover, the yields on two-year gilts, which indicate changes in borrowing costs, decreased by 8 basis points to 3.526%. This is the lowest level these yields have reached since April 2023. The movement in gilt yields directly reflects the changing expectations for interest rates and overall economic sentiment.

Last week, the BoE reduced its main interest rate from 5.25% to 5.0%. This was a notable event as it marked the first rate cut since 2020 and came after the rate had reached a 16-year high. The central bank’s decision to lower the rate highlights its concerns about the economic outlook and its readiness to support the economy by making borrowing cheaper.

Overall, the decline in the British pound and bond yields underscores the market’s reaction to the Bank of England’s expected monetary policy changes. Investors closely watch these developments, which will significantly affect the UK economy.

Comments are closed.