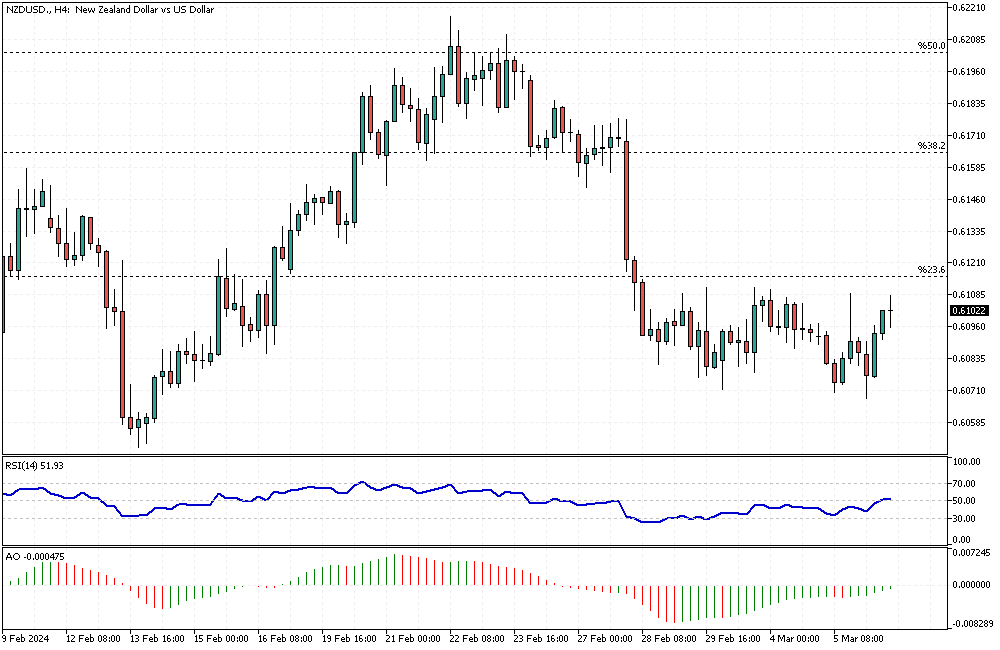

NZDUSD Fundamental Analysis – March-6-2024

The value of the New Zealand dollar has dropped below 0.61 dollars, the lowest it has been in two weeks. This drop is because the Reserve Bank of New Zealand (RBNZ) decided not to increase interest rates.

They met in February, and their view on future financial plans wasn’t as strict as people thought it would be. The RBNZ has decided to keep the interest rate at 5.5% for the fifth time. This was expected by most people.

RBNZ’s Outlook on Inflation and Interest Rates

Even though the interest rates stayed the same, the RBNZ shared some good news. They have made some progress in reducing inflation. Because of this, they now think the highest interest rate will be 5.6% instead of 5.7%. After hearing this, people are less sure that there will be a rise in rates by May.

Before the RBNZ meeting, almost half thought there would be an increase. Now, only 20% think so. This change in expectations is important for investors and the economy.

RBNZ’s Confidence in Economic Management

Adrian Orr, who is in charge of the RBNZ, believes that the current interest rate is good enough to reduce spending. He thinks this will help bring inflation back to the normal range of 1% to 3% within this year. This shows that the RBNZ is confident in handling the economy.

They think their strategies are working to control inflation without making big changes in interest rates. This approach affects how people invest and spend money in New Zealand.

Comments are closed.