AUDUSD Fundamental Analysis – 24-September-2024

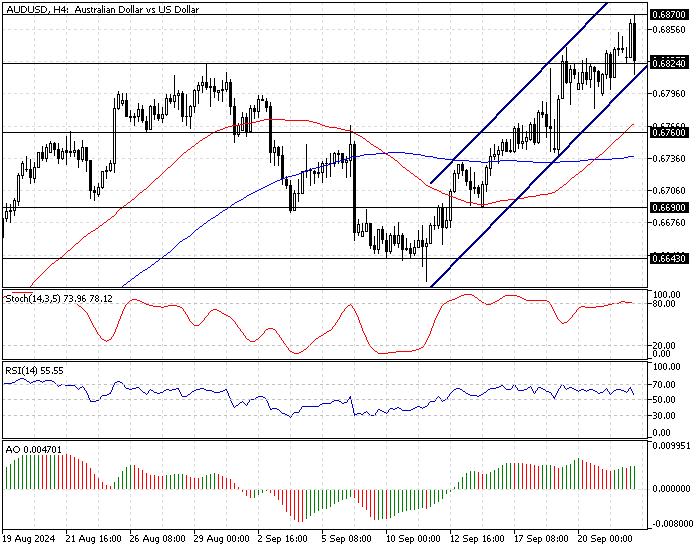

On Tuesday, the AUD/USD dropped to $0.683, losing earlier gains that had marked the highest values of the year. This decline followed statements from Michele Bullock, the Governor of the Reserve Bank of Australia (RBA), made after the bank’s latest policy decision.

Central Bank’s Stance on Interest Rates

At their recent meeting, Governor Bullock clarified that the RBA had decided against raising interest rates. She emphasized the bank’s readiness to adjust its policies based on new economic data, indicating a flexible approach to future monetary decisions.

Reasons Behind the Decision

Many anticipated the RBA’s decision to maintain the cash rate at 4.35%, which was driven by continuous high inflation rates and the prevailing economic uncertainties.

Bullock’s remarks noted that inflation is not expected to stabilize within its target range soon, hinting that current interest rates might be maintained longer to counter prolonged inflationary pressures.

Economic Outlook and Future Projections

The central bank’s recent projections have led to expectations that achieving inflation targets might take longer.

This outlook suggests a cautious approach from the RBA, potentially leading to a prolonged period of steady interest rates to ensure economic stability.

Conclusion: Navigating Economic Uncertainty

The Australian dollar’s recent fluctuations reflect the complex economic landscape governed by inflation dynamics and policy decisions.

The RBA’s cautious stance in holding the interest rate steady amidst high inflation and economic uncertainty aims to provide a balanced approach to achieving long-term financial stability.

Moving forward, the bank’s adaptability to evolving economic data will be crucial in steering Australia’s financial path through these challenging times.

Comments are closed.