GBPUSD Fundamental Analysis – 24-September-2024

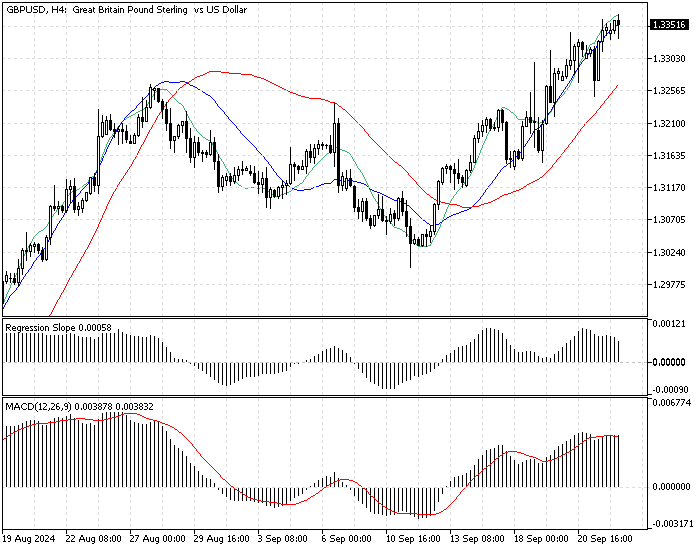

The GBP/USD pair has reached its highest value since March 2022, climbing to $1.33. This surge came after the Bank of England’s decision in September 2024 to maintain the interest rate at 5%.

This decision met the market forecasts and was accompanied by the central bank’s statement favoring a cautious and gradual approach to policy adjustments.

Market Reactions and Projections

The trading community had anticipated deeper rate cuts, predicting around 52 basis points by the end of the year. However, post-decision expectations have adjusted to foresee lesser rate reductions, about 42 basis points, by year-end.

In contrast, the US Federal Reserve opted for a significant 50 basis point cut and hinted at more reductions to come this year and next. This move has put downward pressure on the US dollar, which, in turn, has boosted the pound.

Inflation Trends in the UK

Regarding inflation, the UK’s annual inflation rate held steady at 2.2% in August, aligning with economic forecasts. Meanwhile, the rate for services inflation reached 5.6%, as expected.

However, the core inflation rate, which excludes volatile items like food and energy, rose slightly above predictions to 3.6%, from the anticipated 3.5%. Notably, the general and services inflation rates remain below the earlier predicted by the Bank of England in August.

Conclusion: A Cautious Outlook

Despite the stable inflation rates, the Bank of England’s careful stance on interest rates reflects a strategic approach to economic stability.

The disparity in rate cuts between the UK and the US has notably favored the pound, suggesting potential shifts in currency strengths as the central banks navigate through economic recovery phases.

This careful balancing act showcases the interconnectedness of global financial policies and their impact on currency valuations.

About The Author

Ethan O. Miller

Ethan O. Miller is a seasoned Forex analyst. His insightful articles offer a unique perspective on currency trends, aiding both novice and experienced traders in navigating the Forex market.

Comments are closed.