AUDUSD Fundamental Analysis – 25-July-2024

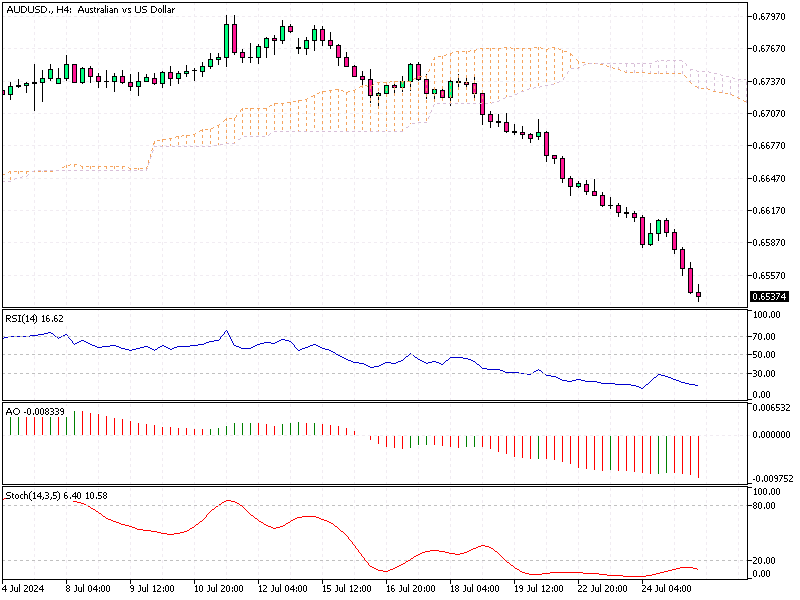

The Australian dollar has fallen to approximately $0.653, marking its ninth consecutive decline and reaching its lowest point in 12 weeks. This trend reflects a broader “risk-off” sentiment in the financial markets, characterized by falling global share markets and commodities.

Investors are turning away from riskier assets, affecting currencies like the Australian dollar.

- Read also: GBP/USD Fundamental Analysis – 25-July-2024

Impact of Commodity Prices

Australia’s economy heavily relies on exporting commodities like oil, iron ore, and copper. Recently, the prices of these key commodities have dropped, putting additional pressure on the Australian dollar. As these commodities become less valuable, the nation’s currency weakens because the revenues from exports diminish.

Yen Strength and Carry Trades

The Australian dollar has also weakened significantly against the yen. This shift is partly due to traders unwinding carry trades before the Bank of Japan’s policy meeting next week. Carry trades involve borrowing in a low-interest-rate currency, like the yen, and investing in a higher-yielding currency, like the Australian dollar.

As traders anticipate changes in Japanese monetary policy, they close these positions, leading to a stronger yen and a weaker Australian dollar.

Upcoming Inflation Data

Investors are keenly awaiting the release of Australia’s second-quarter inflation data next week. This data will provide insights into the country’s economic health and influence expectations regarding the Reserve Bank of Australia’s (RBA) future monetary policy decisions.

Higher inflation could prompt the RBA to raise interest rates, potentially strengthening the Australian dollar.

Shifting Speculations on RBA Rate Hikes

Earlier this month, speculation that the RBA might raise interest rates again led to a surge in the Australian dollar to a six-month high. However, increasing uncertainty has caused market participants to reassess and unwind those bets.

This shift reflects the complex and dynamic nature of economic forecasting and its impact on currency values.

AUDUSD Fundamental Analysis – 25-July-2024

In conclusion, the Australian dollar’s recent decline underscores the interconnectedness of global financial markets. Factors such as commodity prices, international monetary policies, and domestic economic data play crucial roles.

As the market awaits upcoming inflation data, investors should remain informed about these variables to effectively navigate the evolving economic landscape.

Comments are closed.