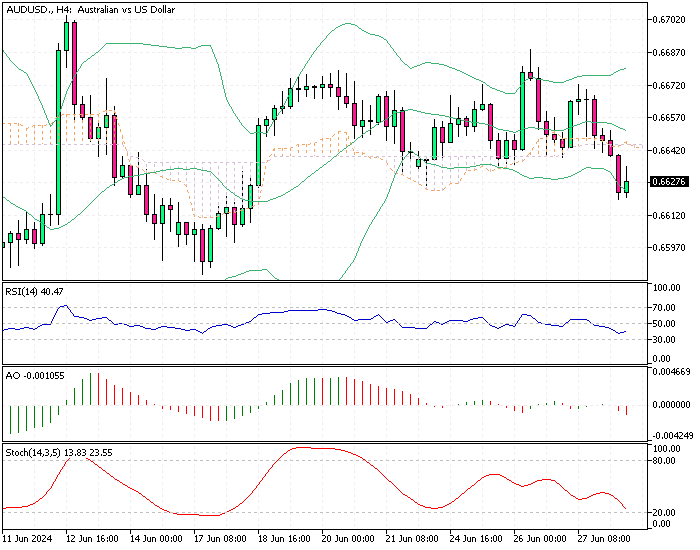

AUDUSD Fundamental Analysis – 28-June-2024

The Australian dollar dropped below $0.662, reaching its lowest in over a week. This decline followed a warning from Reserve Bank of Australia Deputy Governor Andrew Hauser. Hauser advised against making policy decisions based on a single high inflation figure and emphasized that the full second-quarter inflation report, expected at the end of July, would offer more insight.

May CPI Data Boosts Rate Hike Odds in Australia

Earlier this week, data showed Australia’s Monthly CPI Indicator rose by 4% in May, up from 3.6% in April, surpassing market predictions of 3.8%. Markets now estimate that there will be a one-third chance of the RBA raising rates in August, dismissing any likelihood of a rate cut this year.

Market Calm After Trump-Biden Debate

Additionally, the Australian dollar faced pressure from a strong US dollar and rising Treasury yields ahead of a critical US inflation report. Market reaction to the initial US presidential debate between Donald Trump and Joe Biden was minimal.

AUDUSD Fundamental Analysis – 28-June-2024

The AUD/USD currency pair has been under pressure recently, with the Australian dollar falling below $0.662. This drop is partly due to comments from Reserve Bank of Australia Deputy Governor Andrew Hauser, who cautioned against making policy changes based on a single high inflation reading. He pointed out that the comprehensive second-quarter inflation report, due at the end of July, will provide better guidance. This sentiment comes after the latest data showed Australia’s Monthly CPI Indicator increased by 4% in May, up from 3.6% in April and higher than the expected 3.8%.

The market’s response to this data suggests a roughly one-third probability that the RBA will raise interest rates in August while ruling out any chance of a rate cut this year.

Additionally, the strength of the US dollar and rising Treasury yields are exerting downward pressure on the Australian dollar. The upcoming US inflation report is another critical factor that could influence the AUD/USD pair. Furthermore, the market’s muted reaction to the first US presidential debate indicates that political events currently have a currency pair.

Overall, the AUD/USD will likely remain volatile as traders await more comprehensive economic data and central bank guidance.

Comments are closed.