EURUSD Fundamental Analysis – 20-June-2024

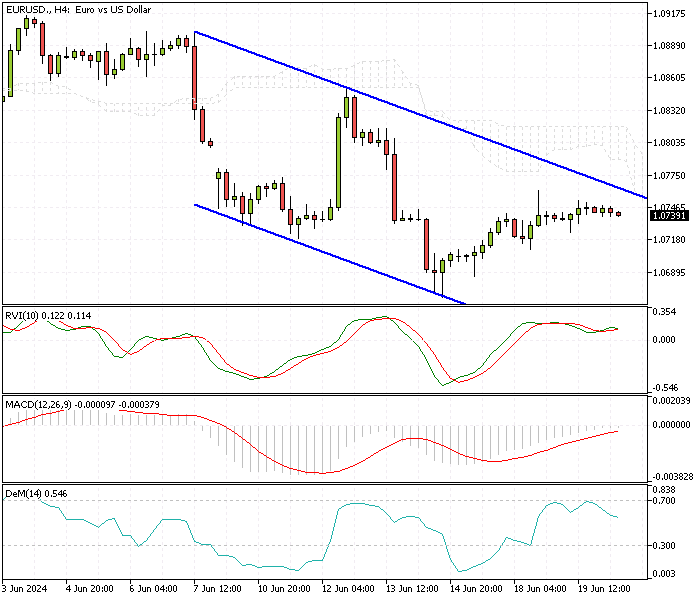

EUR/USD—The Euro has stabilized around $1.07, holding seven-week lows after a 0.8% decline last week. This stability comes as market participants keenly watch the political situation in France, where legislative elections are scheduled for June 30th and July 7th.

France’s Fiscal Health in Jeopardy

The far-right National Rally, leading in the polls, has proposed policies like cutting sales taxes and reducing the retirement age. These proposals have heightened investors’ concerns about potential increases in government spending, which could harm France’s fiscal health. Consequently, France’s risk premium and bond yields have risen sharply.

In an attempt to calm these fears, Marine Le Pen, leader of the National Rally, assured Le Figaro in an interview that she respects institutional norms and would not seek to oust President Macron if she wins. She aimed to reassure moderates and investors alike.

Eurozone Wages Surge Amid Inflation

On the economic front, the European Central Bank (ECB) recently implemented its first rate cut in five years. However, the ECB remains cautious about further cuts due to ongoing inflationary pressures. Notably, wages in the Eurozone increased by 5.3% year-on-year in Q1, marking the highest rise since Q4 of 2022. This wage growth signals persistent inflation concerns, influencing the ECB’s measured approach to monetary policy.

Understanding these dynamics helps investors and observers gauge the economic landscape and make informed decisions.

Comments are closed.