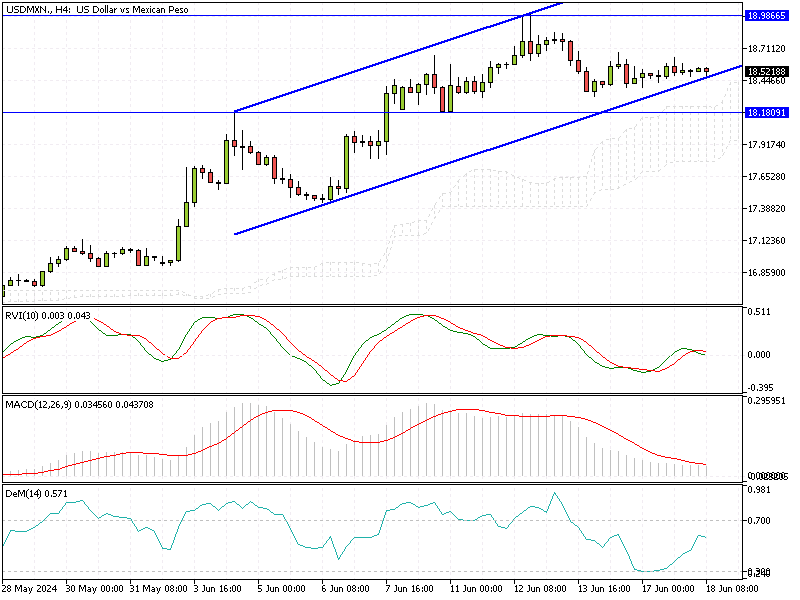

USDMXN Analysis – 18-June-2024

USD/MXN—In June, the Mexican peso weakened to around 18.5 per USD, nearing its fifteen-month low of 18.75 on June 12th. This decline followed a brief recovery sparked by Banxico’s Victoria Rodriguez Ceja, who hinted at possible interventions to stabilize the currency.

However, the recovery was short-lived due to ongoing selling pressure linked to anticipated policy changes by Mexico’s newly elected government.

Moderna Plans Popular Vote for Judges

The incoming administration, led by Moderna’s majority congress, has proposed several significant reforms. These include raising the minimum wage, increasing state-sector pensions, abolishing independent regulators, and a controversial plan to elect judges via popular vote rather than appointment.

These changes could disrupt institutional checks and balances, complicating Banxico’s efforts to control inflation.

Mexican Peso Drops 10% Post-Election

The Mexican peso has depreciated by approximately 10% since the elections, marking it as one of the world’s worst-performing currencies in June. This depreciation reflects investor concerns about the proposed reforms and their impact on the country’s economic stability.

Summary

Staying informed about these developments is crucial for individuals and businesses interested in Mexico. Understanding the potential implications of these policy changes can help make more informed decisions regarding investments, trade, and financial planning.

Monitoring Banxico’s actions and government policies will be essential for navigating the economic landscape as the situation evolves.

Comments are closed.