GBPUSD Fundamental Analysis – 2-July-2024

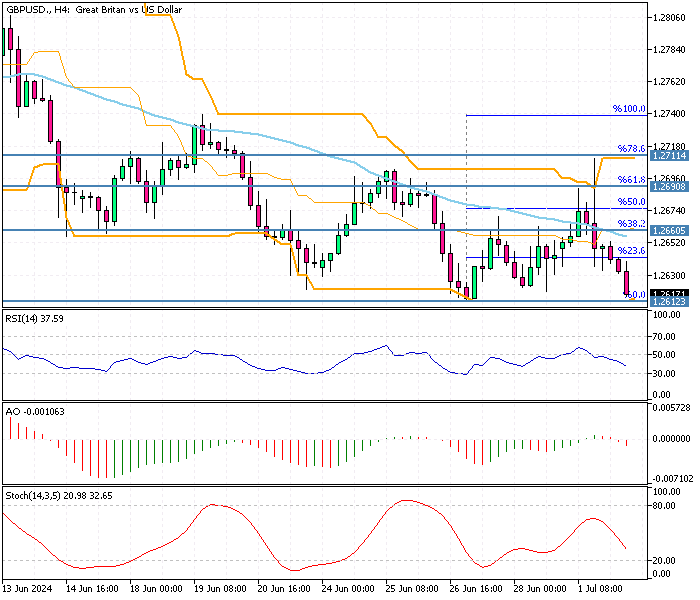

GBP/USD—The British pound has recently shown signs of strength, rising to $1.261, indicating a resilient economy despite the upcoming parliamentary elections. This upward trend comes as the nation braces for potential political upheaval, with opinion polls suggesting a significant loss for the Conservative party, which has held power for the past 14 years.

Political Shifts Impacting Pound’s Value

The political landscape is a crucial factor influencing the pound’s value. A potential shift in power introduces uncertainty, which typically leads to market volatility.

However, the pound’s recent strength suggests that investors might be optimistic about the economic policies and reforms that a new government could bring. A government change could stimulate new financial strategies to boost growth and stability.

UK Economy Recovery Signs Amid Challenges

Recent economic indicators present a mixed picture of the UK’s financial health. On the one hand, there are signs of recovery. Conversely, challenges remain, particularly in consumer borrowing and the housing market.

Consumer Borrowing Shows Modest May Increase

Consumer borrowing slightly increased in May following a dip in April. This rise, although modest, indicates a cautious return of consumer confidence. Borrowing trends are vital indicators of economic health as they reflect consumer spending capacity and overall economic activity.

A steady increase in borrowing can signal economic growth, but it must also be monitored to prevent excessive debt accumulation, which can lead to financial instability.

Housing Market Faces High Borrowing Costs

The housing market continues to grapple with high borrowing costs. June saw only minimal price growth, as reported by Nationwide. High borrowing costs deter potential buyers, reducing demand and sluggish price growth.

The housing market is a significant component of the economy, influencing sectors like construction, retail, and banking. Prolonged stagnation in this market could have broader implications for economic growth.

Inflation Hits BoE Target

Inflation has now aligned with the Bank of England’s (BoE) target of 2%, indicating price stability. Despite this, the BoE decided to keep interest rates unchanged in June, sparking speculation about a potential rate cut in August.

BoE Holds Rates Steady Amid Inflation Watch

Inflation measures the rate at which prices for goods and services rise, and it is a critical indicator of economic health. The BoE uses interest rates as a tool to control inflation. Lower interest rates reduce borrowing costs, encouraging spending and investment, which can stimulate economic growth. However, if rates are too low, it can lead to excessive inflation.

The decision to keep rates unchanged suggests that the BoE is taking a cautious approach, possibly waiting for more data to ensure that the inflation target is maintained sustainably. Speculation about a potential rate cut in August indicates that the BoE might prepare to stimulate the economy further if needed.

GBPUSD Fundamental Analysis – 2-July-2024

The pound’s current strength, political uncertainty, mixed economic indicators, and potential changes in monetary policy all paint a complex picture of the UK’s financial outlook. If the upcoming elections lead to a change in government, we might see new economic policies that could either bolster confidence further or introduce new uncertainties.

A potential rate cut by the BoE in August could boost the economy by making borrowing cheaper, encouraging investment and spending. However, this must be balanced against the risk of rising inflation.

Final Words

In summary, while the UK economy shows signs of resilience, the interplay between political developments, consumer behavior, housing market trends, and monetary policy will be crucial in shaping its future trajectory. Investors and consumers should stay informed and prepared to adapt to these evolving economic conditions.

Comments are closed.