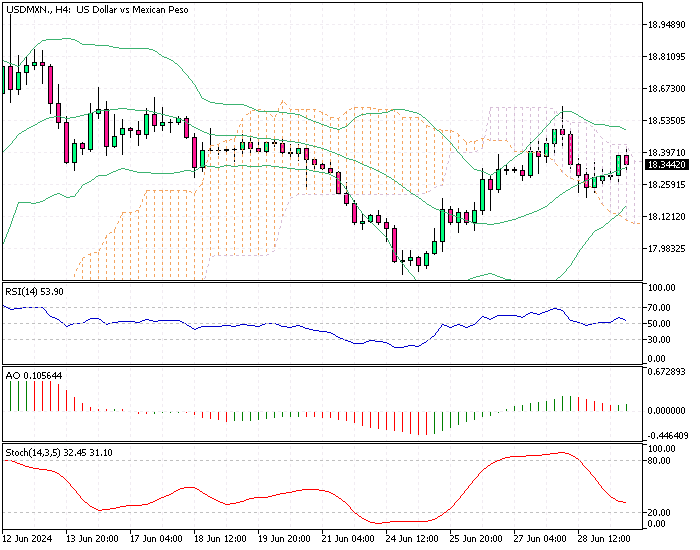

USDMXN Analysis – 1-July-2024

USD/MXN—The Mexican peso has recently experienced notable turbulence, weakening to 18.4 per USD and approaching its fifteen-month low of 18.75, recorded on June 12th. This movement comes as investors digest the latest decisions by the Bank of Mexico (Banxico) and the country’s economic data. Understanding these shifts is crucial for making informed decisions in today’s market.

Banxico’s Interest Rate Decision

During its June meeting, Banxico, Mexico’s central bank, decided to maintain its interest rate at 11%. This move was widely anticipated and reflects the central bank’s ongoing commitment to controlling inflation. Interest rates are a critical tool for central banks to influence economic activity. By keeping rates high, Banxico aims to curb inflation by making borrowing more expensive, which in turn can reduce spending and slow down price increases.

Mexico’s Inflation Surges to 4.78% in June

Inflation in Mexico rose to 4.78% by mid-June, surpassing expectations. Inflation represents the rate at which the general prices for goods and services increase and, subsequently, power. High inflation can lead to higher costs of living and can impact savings and investments. Banxico’s decision to hold the interest rate is a strategy to address this challenge, demonstrating their focus on utilizing the economy.

Mexico’s Job Market Shines in May

Despite the concerns over inflation, Mexico’s economic data in other areas show positive signs. The unemployment rate dropped to 2.6% in May, better than the forecasted 2.7%. A lower unemployment rate indicates a healthy labor market and suggests more people are employed and contributing to the economy. This is a good indicator of economic strength.

Mexico Achieves $1.99B Trade Surplus in May

Additionally, Mexico’s trade balance showed a surprising surplus of $1.99 billion in May, significantly above the anticipated deficit of $2.04 billion. A trade surplus means that the value of the country’s exports exceeds the value of its imports, which is generally a positive indicator for the economy.

This surplus could be due to increased demand for Mexican goods abroad or decreased imports, signaling strong economic fundamentals.

Peso Faces Pressure Amid Policy Concerns

Despite these robust economic indicators, the peso has been under pressure due to concerns over policy reforms proposed by the Morena party in June. Political uncertainty can create market volatility as investors react to changes that could impact the economic environment.

These reforms and the resulting uncertainty can test institutional oversight and Banxico’s efforts in managing inflation and maintaining financial stability.

USDMXN Analysis – 1-July-2024

Economic data and political developments will likely continue to influence the peso’s performance. The peso could regain strength if Banxico can successfully manage inflation and achieve political stability. However, ongoing concerns over policy reforms could continue to cause fluctuations.

Investors should closely monitor upcoming economic data releases and any new policy announcements. Staying informed about Banxico’s future interest rate decisions will also be crucial, as they will impact borrowing costs and investment decisions. Understanding these factors will help in making informed decisions in a volatile market.

Final Words

The recent weakening of the Mexican peso underscores the complex interplay between economic indicators and political developments. While robust economic data such as low unemployment and a trade surplus are encouraging, inflation concerns and political uncertainties pose challenges.

By closely monitoring these factors, investors can navigate the market more effectively, making well-informed and strategically sound decisions.

Comments are closed.