NZDUSD Fundamental Analysis – 31-May-2024

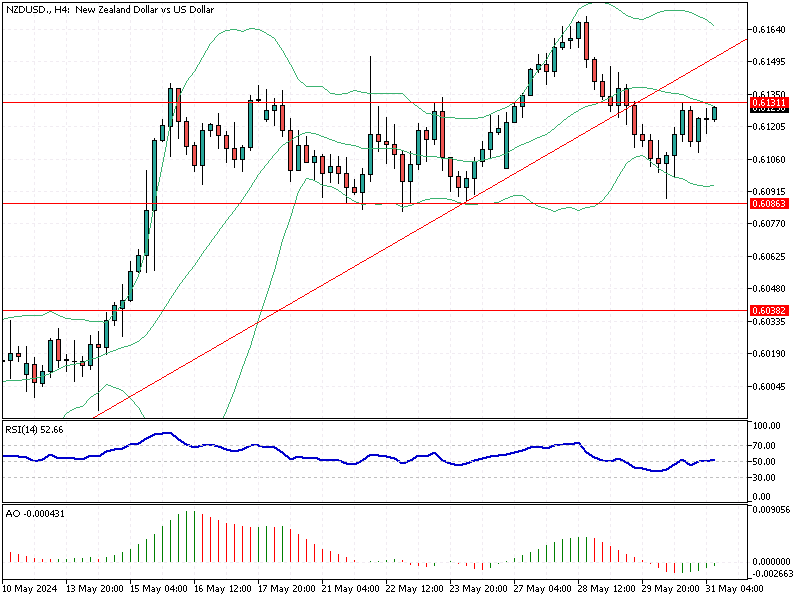

The New Zealand dollar steadied at around $0.612 amid a steady US dollar (NZD/USD) as investors anticipated the US PCE inflation data release. This data is crucial as it could provide further insights into the future path of the Federal Reserve’s monetary policy. On Thursday, revised data revealed that the US economy grew slower than initially expected in the first quarter, suggesting potential room for US rate cuts this year.

RBNZ Governor Speech: Key Takeaways for Investors

In New Zealand, all eyes are on RBNZ Governor Adrian Orr’s speech today, following the central bank’s policy decision last week. The RBNZ projects a steady policy until mid-2025. Markets have also adjusted their expectations for a rate cut from the central bank. There is only a 37% chance of a quarter-point easing in October, but a rate cut is fully priced in for November.

Staying informed about these economic indicators is crucial for investors. The interplay between US and New Zealand economic policies can significantly impact currency values and investment strategies. Recent data highlights the importance of understanding local and international economic signals.

Investors can make more informed decisions by closely monitoring speeches from central bank officials and key economic data releases.

Summary

In summary, the current economic environment suggests a cautious approach. With potential rate cuts in the US and steady policies projected in New Zealand, the financial landscape is set for significant developments in the coming months. Staying updated and understanding these changes will be key to making informed investment choices.

Comments are closed.