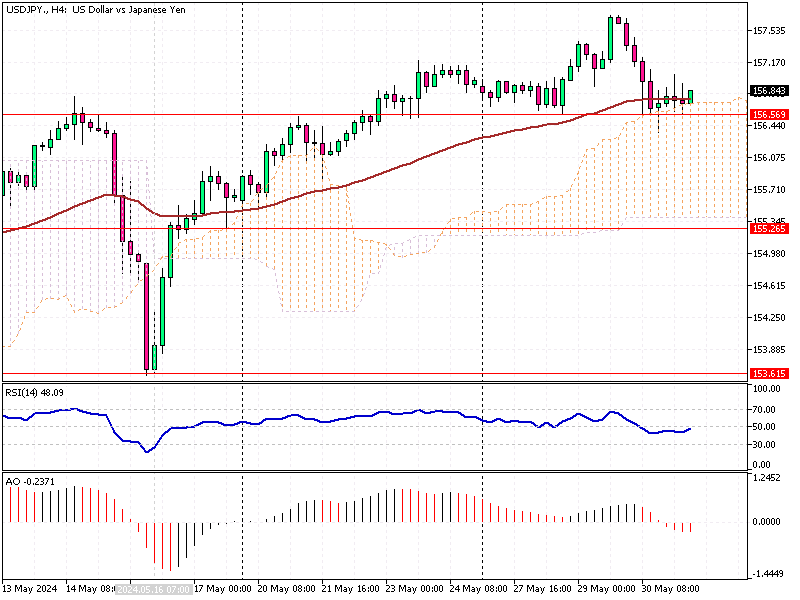

USDJPY Fundamental Analysis – 31-May-2024

The Japanese yen appreciated past $156.8 (USD/JPY), rebounding from recent lows. This surge was driven by a broad selloff in risk assets, prompting investors to seek the yen as a safe-haven currency. Additionally, domestic yields provided support, with Japan’s benchmark 10-year yield reaching 1.1% for the first time since July 2011.

Yen Inflation Woes May Trigger Rate Hike

Earlier this week, Seiji Adachi, a Bank of Japan board member, suggested that the central bank might raise interest rates if sharp declines in the yen continue to fuel inflation. Recent data revealed that Tokyo’s core inflation rate accelerated to 1.9% in May, up from 1.6% in April, yet still below the BOJ’s 2% target.

On the international front, the yen gained further support towards the end of the week. A downward revision in US first-quarter GDP data rekindled hopes for US rate cuts. However, this optimism was tempered by strong economic reports and hawkish comments from Federal Reserve officials, which muddied the economic outlook.

Yen’s Surge: Key Factors for Forex Investors

Understanding these shifts is crucial for investors and those interested in the forex market. The yen’s rise reflects domestic and international factors, signaling market volatility and potential opportunities. Monitoring central bank policies and economic indicators, such as inflation rates and yield movements, can help make informed decisions in this dynamic environment.

In summary, the yen’s recent appreciation underscores the importance of staying updated on economic data and central bank actions to effectively navigate the complex forex landscape.

Comments are closed.