NZDUSD Fundamental Analysis: The Kiwi Positive Trend

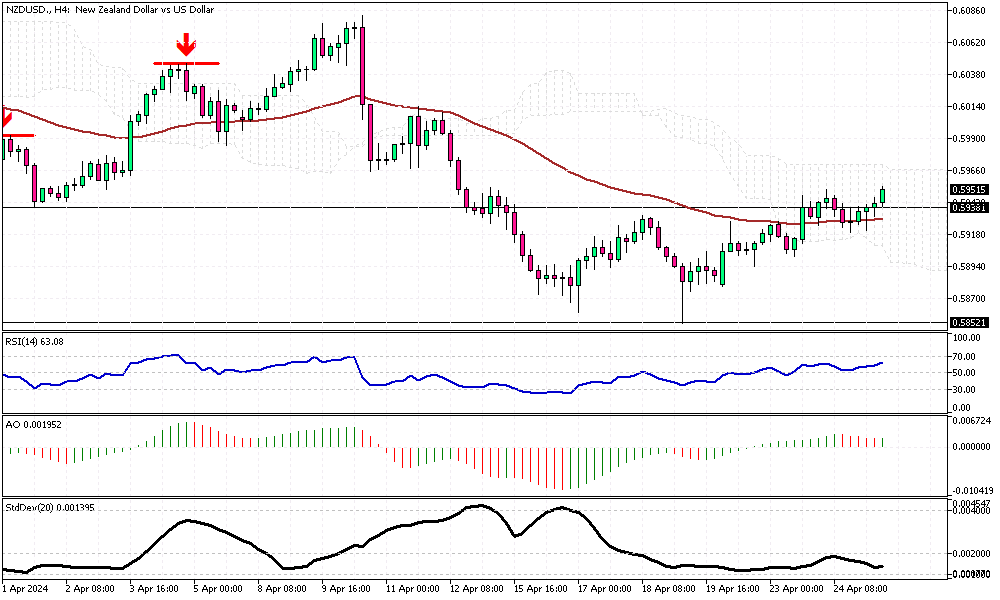

NZDUSD Fundamental Analysis – The New Zealand dollar, often called the Kiwi, has recently seen a modest increase in value, trading at just over $0.594. This uptick is primarily due to a global increase in risk appetite and a slight weakening of the US dollar.

Investors have regained confidence, escaping from the initial panic that caused a flight to safety last week. This shift in sentiment comes amidst expectations that the ongoing tensions between Iran and Israel will not escalate further.

Impact of US Economic Data

Disappointing economic indicators from the United States also bolster the Kiwi’s strength. Recent data revealed a contraction in US manufacturing activity and a growth slowdown in the services sector. These developments have fueled speculation that the US Federal Reserve might consider reducing interest rates to support economic growth.

A potential rate cut typically weakens the home currency, in this case, the US dollar, which has worked in favor of the Kiwi.

New Zealand’s Economic Outlook

Domestically, the economic landscape in New Zealand remains cautiously optimistic. The Reserve Bank of New Zealand (RBNZ) has decided to maintain the official cash rate at 5.5% this month. This decision reflects the central bank’s strategy to keep monetary policy tight, aiming to bring inflation back within the target range of 1-3%.

Remarkably, New Zealand’s annual inflation rate has dropped to 4% for the first quarter of 2024, marking the lowest rate since the second quarter of 2021. The RBNZ emphasized the need for a sustained restrictive policy to ensure that inflation continues trending downward.

Comments are closed.