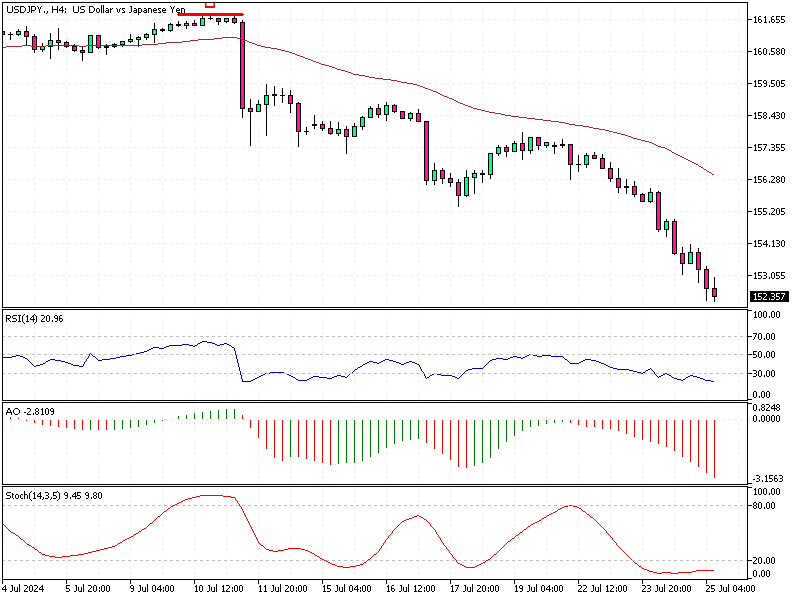

USDJPY Fundamental Analysis – 25-July-2024

The Japanese yen has surged past 152 per dollar, marking its strongest performance in 12 weeks. This appreciation comes as investors unwind carry and short trades ahead of the upcoming Bank of Japan (BOJ) policy meeting.

The carry trade involves borrowing in a low-interest-rate currency, such as the yen, to invest in higher-yielding assets. Unwinding these trades increases demand for the yen, boosting its value.

- Read also: NZD/USD Fundamental Analysis – 25-July-2024

Safe-Haven Demand Amid Global Uncertainty

The yen’s strength is also attributed to its status as a safe-haven currency. Investors flock to safe-haven assets during economic uncertainty, and recent disappointing corporate earnings reports and a bleak global economic outlook have triggered such a move. As growth stocks and commodities faced sell-offs, the yen benefited from this increased demand for safety.

Upcoming BOJ Policy Meeting and Market Expectations

Markets are closely watching the BOJ’s policy meeting next week. While there is division on whether the BOJ will raise interest rates, there is a broad expectation that it will announce plans to taper its bond purchases.

This tapering is part of the BOJ’s efforts to unwind its extensive monetary stimulus gradually. Top Japanese officials are urging the BOJ to communicate clearly on its intentions to normalize monetary policy.

Government Intervention and Yen Surge

The yen’s recent surge was initially sparked by suspected government intervention. Data from the BOJ suggests that authorities may have purchased nearly 6 trillion yen on July 11-12 to support the currency.

This intervention, aimed at stabilizing the yen, indicates the government’s proactive stance in managing the currency’s value amidst fluctuating market conditions.

Market Forecast and Investor Sentiment

Investors need to stay informed about the BOJ’s policy decisions and the broader economic landscape as the yen strengthens. The yen’s movement provides insights into market sentiment and economic stability.

By understanding these dynamics, investors can make more informed decisions and anticipate potential market shifts based on the BOJ’s actions and global economic indicators.

Comments are closed.