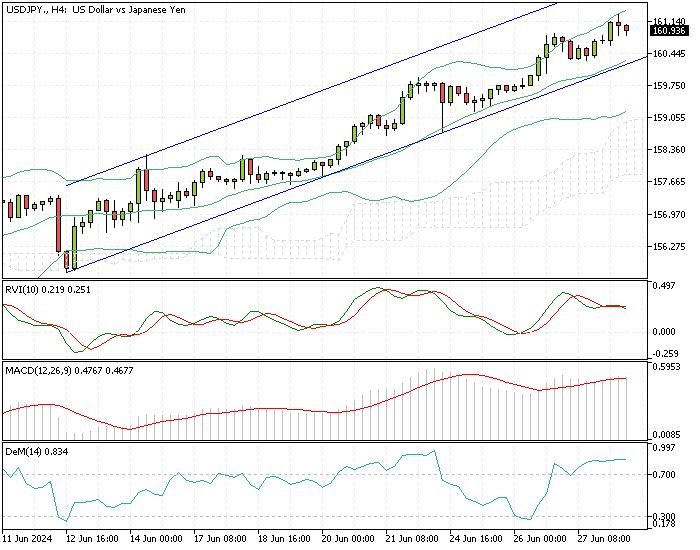

USDJPY Fundamental Analysis – 28-June-2024

USD/JPY—The Japanese yen has recently weakened to around 161 per dollar, a level not seen since 1986. This significant depreciation has put immense pressure on Japanese authorities tasked with defending the currency. The Ministry of Finance has responded by appointing Atsushi Mimura as Japan’s top currency diplomat, replacing Masato Kanda.

This change in leadership comes amidst growing concerns over the yen’s sharp decline and its broader economic implications.

Yen Declines 14% in 2024 Amid Dollar Surge

The yen has lost over 2% against the dollar in June alone, contributing to a year-to-date decline of approximately 14%. Several factors contribute to this weakening:

How BOJ’s Policy Impacts the Yen’s Strength

The Bank of Japan (BOJ) has adopted a more moderate stance in normalizing monetary policy than other major central banks. While the Federal Reserve and European Central Bank have aggressively raised interest rates to combat inflation, the BOJ has maintained a more cautious approach.

This policy divergence makes the yen less attractive to investors seeking higher returns, weakening its value against stronger currencies like the dollar.

BOJ’s Slow Moves Deepen Yen’s Decline

Markets anticipated a more proactive approach from the BOJ towards tightening monetary policy. However, the BOJ’s slower pace has led to a mismatch between market expectations and actual policy actions, further exacerbating the yen’s decline.

Yen Struggles Despite Strong Economic Data

Interestingly, recent economic data from Japan has shown stronger-than-expected performance. Retail sales and industrial production data for May exceeded expectations, and Tokyo’s inflation rate accelerated in June. Despite these positive indicators, the yen continues to struggle, suggesting that broader macroeconomic and policy factors are at play.

Japan’s Finance Minister Warns on Yen Volatility

Finance Minister Shunichi Suzuki has expressed concern over sudden and one-sided moves in the yen. He emphasized that such volatility is undesirable and assured the authorities that appropriate action would be taken when necessary. However, despite these warnings, there has been no direct intervention in the foreign exchange markets since late April.

The appointment of Atsushi Mimura as the new top currency diplomat indicates a strategic shift. Mimura’s role will be crucial in navigating the current economic landscape’s complexities and formulating policies to stabilize the yen.

USDJPY Fundamental Analysis – 28-June-2024

Potential Intervention: If the yen continues to depreciate at its current pace, Japanese authorities might be compelled to intervene directly in the foreign exchange markets. Such intervention could provide temporary relief but not address the underlying factors driving the yen’s weakness.

Monetary Policy Adjustment: The BOJ could adopt a more aggressive stance on monetary policy. This shift could involve raising interest rates or other measures to tighten monetary policy, which might help strengthen the yen. However, this approach carries the risk of slowing down economic growth.

External Influences: Global economic conditions, including the actions of other central banks and geopolitical events, will continue to influence the yen. Any significant changes in the global economic environment could either exacerbate or alleviate the pressures on the yen.

Summary

The current weakening of the Japanese yen reflects a complex interplay of domestic monetary policies, market expectations, and broader economic conditions. The recent appointment of Atsushi Mimura as the top currency diplomat underscores the Japanese government’s commitment to addressing these challenges.

However, the path forward remains uncertain, with potential interventions and policy adjustments on the horizon. For investors and market watchers, staying informed about these developments is crucial for making well-informed decisions in an increasingly volatile economic landscape.

Comments are closed.