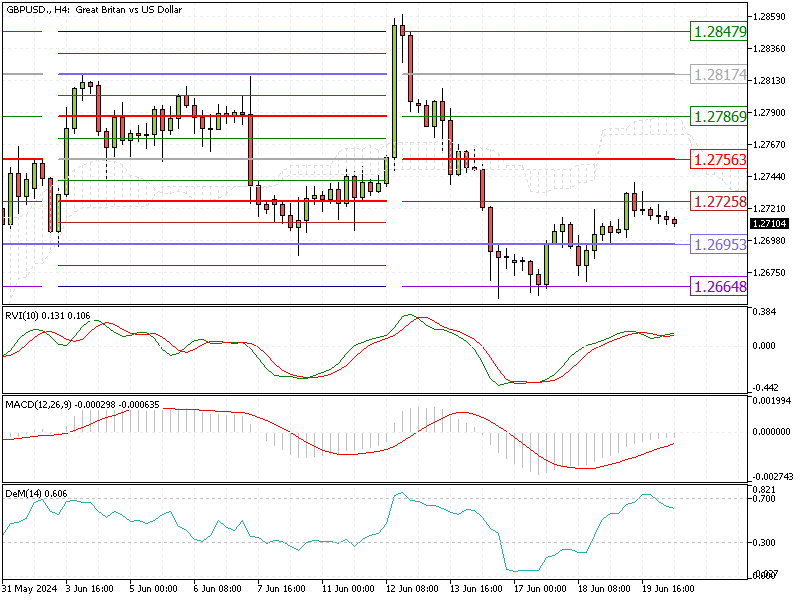

GBPUSD Fundamental Analysis – 20-June-2024

GBP/USD—On Wednesday, the British pound saw a slight increase to $1.27 as traders absorbed new inflation data and anticipated the Bank of England’s upcoming monetary policy decision. In May, UK inflation met the central bank’s target of 2%, with core inflation easing to 3.5% from 3.9%, aligning with forecasts.

However, services inflation only dipped slightly to 5.7%, higher than the expected 5.5%.

BOE Expected to Keep Rates at 5.25%

Despite reaching its inflation target, the Bank of England has clarified that this alone will not trigger interest rate cuts. In its decision tomorrow, the bank is expected to maintain the key interest rate at a 16-year high of 5.25%. Most economists anticipate two rate cuts later this year, possibly beginning in August, though the latest CPI report has tempered these expectations.

Labour Party Leads in July 4th Polls

On the political front, recent polls indicate a lead for the Labour Party in the upcoming July 4th election, with Prime Minister Rishi Sunak’s Conservative Party trailing in second place. This political shift could impact economic policies and market sentiment.

How Interest Rates Affect Your Finances

Understanding these developments is crucial for making informed financial decisions. The Bank of England’s stance on interest rates and inflation directly influences borrowing costs and investment returns. Meanwhile, political changes can lead to shifts in economic policy, affecting everything from taxation to public spending.

Keeping abreast of these factors helps individuals and businesses navigate the financial landscape more effectively.

Comments are closed.